Analysts watch impact of processing plant fire

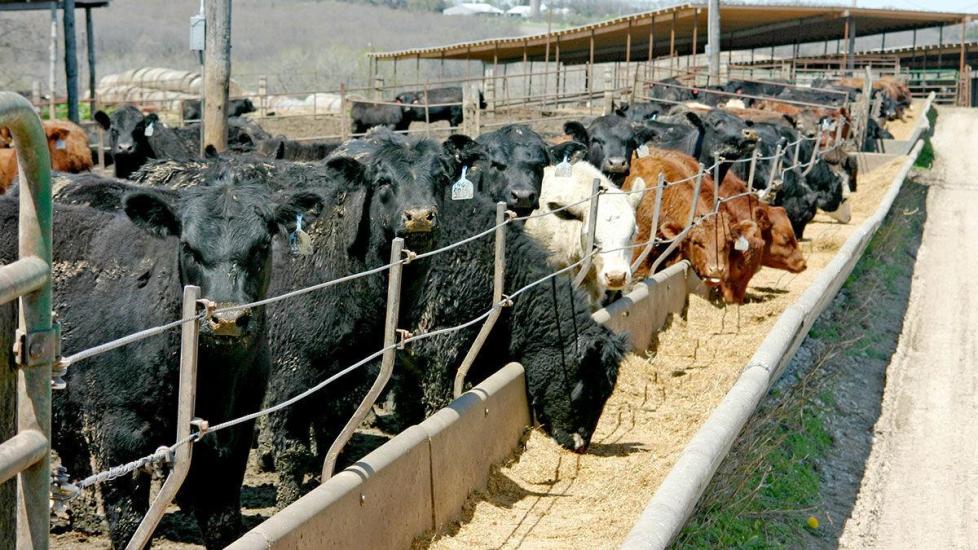

Analysts are watching to see the impacts the JBS meat processing plant fire will have on markets. Elliott Dennis, livestock Extension economist for the University of Nebraska, said in his “In the Cattle Markets” column for the Livestock Marketing Information Center that the plant, located in Grand Island, Nebraska, has similarities to the Tyson plant fire in Kansas.

“Both plants processed about 6,000 head per day or approximately 6% of total daily beef slaughter,” he says.

With the similarities, the previous experience could hint at what lies ahead for markets.

“We learned several lessons from the Holcomb, Kansas, fire that could apply to the Grand Island, Nebraska, fire,” Dennis says. “First, live cattle prices are likely to fall given the now over supply of harvest-ready cattle relative to processing capacity. Second, wholesale cutouts are likely to increase as retailers seek to make advance purchases on beef. Combined, these will likely widen beef processing margins – something that has been curiously and intensely watched since 2019.”

Two key factors will help determine the outcomes, Dennis says.

“The market will look for two signals to regulate this margin,” he says. “One, will the damaged plant be rebuilt, and two, how long will the plant be shut down before it will be fully operational.”

Dennis says the incident could impact feeder cattle producers negatively.

Dennis says the Holcomb fire in Kansas had a variety of impacts, and the JBS fire could have some similar outcomes.

“Although the plant fire primarily affected fed cattle, it did influence feeder cattle prices,” he says. “Feeder cattle have already started to enter feedlots earlier than in previous years as drought and reduced forage production has forced some feeder cattle producers to market feeder cattle earlier.”

The fire could impact how full pens are and what price feeder cattle can bring, Dennis says.

“If pens continue to stay full, this could reduce the price feedlots would be willing to pay for feeder cattle,” he says. “This combined with potentially higher feed grain prices both have the potential for increased downside price movements.”

View more on Mainline Media News